Love Your Customers?

Let’s Protect Them Like Family

Give them an Aster Key secured app

Why We Invented Aster Key

Data breaches are accelerating—and today’s cybersecurity standards can’t keep up. Financial products like mortgages are weighed down by legacy systems, too many steps, and unnecessary risk. And with AI exploding, protecting customer data is about to get even harder.

Aster Key is the first app of its kind: a privacy-first, ad-free, easy-to-use financial superapp that runs fully decentralized—right on your customer’s device.

We’re seizing this moment of convergence—mobile, blockchain, and AI—to deliver powerful features by anonymizing data at the source. The result: faster, smarter, more secure experiences that never compromise on privacy.

It’s how your brand earns trust, builds loyalty, and stays secure in a world where privacy is power.

Most finance platforms still operate on a flawed assumption: consumer data belongs to the company, not held in trust for the individual.

Sensitive data—banking info, tax returns, Social Security numbers—gets scattered across internal systems and third-party vendors. Every handoff adds risk. Every silo adds exposure.

The result? Consumers lose control. Institutions lose visibility. Everyone loses their data. This model isn’t just outdated—it’s unsustainable.

Financial data breaches happen daily. On the dark web, stolen profiles can sell for $50 to $2,000—depending on how complete they are.

The fallout—lawsuits, lost business, regulatory fines, and reputational damage—can cost institutions millions.

It starts with a mindset shift: your customer’s data isn’t a resource to exploit—it’s a responsibility to protect.

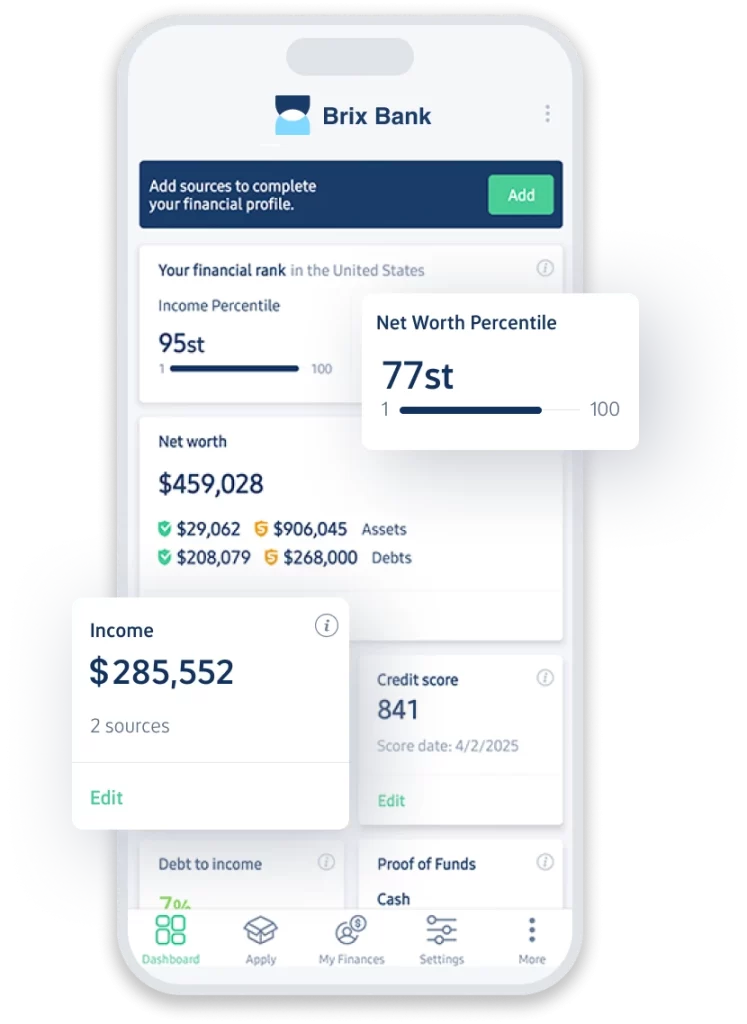

Aster Key’s power is delivered through an easy-to-use consumer app. It puts customers in control—letting them manage their finances, access tools once locked behind enterprise systems, and apply for products like mortgages, all while staying in control.

Think of it as your own Rocket Money or Credit Karma, rebuilt for the era of privacy and trust—under your brand. You get a smarter, safer way to engage customers, stand out in the market, and build loyalty that lasts.

“Aster Key is a game changer, having the consumer control their information and secured in one place”

– Sanjiv Das, past CEO of CitiBank Mortgage

How it works

🤝 Your Brand, Our Tech

We power your private-labeled, secure financial wallet— a next-gen experience your customers will love and trust.

🛡️Unmatched Data Protection

The Aster Key engine runs directly on the user’s device. Our patented architecture keeps financial data separated from personal identity—and off central servers—making attacks extraordinarily difficult and far less valuable to hackers.

🔒 You Stay Connected

Consumers choose when and how to share their data—on their terms. This empowers them with control while enabling you to deliver more respectful and personalized service.

Protecting Customers Like Family

So next time you say you treat customers like family, ask yourself: Am I doing enough to truly protect and empower them?

Protect your customers—and your company—with Aster Key’s transformational data security, designed to complement your existing systems and workflows.

Winner, Fintech Product of the Month

– Product Hunt

Benefits for Lenders Using Aster Key

Get AI-Ready

Deliver personalized guidance—right within the Aster Key app—using the consumer’s own anonymized data.

Confidence Through Security

Privacy-conscious consumers engage when they feel secure.

Reduce Loan Application Abandonment

Borrowers who are hesitant to share data can start the process incognito, increasing lead conversion.

Differentiate Your Brand

Stand out with security-first lending in a crowded market.

Enhance Compliance & Reduce Risk

Decentralized data storage reduces your hacking attack surface.

Attract High-Value Borrowers

Appeal to security and privacy-focused groups like military members, data theft victims, tech-savvy millennials and Gen Z, and high-net-worth individuals.

Testimonials

Aster Key remakes lending to everyone’s advantage